Financial Services

Essential Capabilities for Financial Services

Cost Optimization

Optimizing operational costs is a key priority. With efficient resources and automation, financial institutions can scale sustainably.

Compliance

Strict regulations like GDPR and PSD2 demand secure systems with data traceability, auditability, and compliance.

Risk Mitigation

Leverage real-time data to enhance fraud prevention, refine risk profiling & support responsible lending while minimizing financial exposure.

Security and Privacy

Cybersecurity is critical - systems need built-in security, encryption, and continuous monitoring to safeguard sensitive data.

Scalable Infrastructure

Financial services need scalable, resilient platforms for growth, analytics, and compliance—powered by flexible architectures.

High Availability

Downtime isn’t an option - financial platforms need high availability, backups, and disaster recovery to ensure continuity and trust.

Technical Challenges

- real-time data processing at scale, processing high volumes of data with low latency is essential for fraud detection, trading, and personalized services,

- external system integrations, integrating third-party services, APIs, and data sources complicates performance and reliability,

- data management and analytics, analyzing large data is hard due to silos, low quality, and the need for smart, personalized decisions,

- building resilient, always-on systems, ensuring high availability, fault tolerance, and disaster recovery is vital for 24/7 operations.

Shifting to Financial Intelligence Revolution

Trusted by financial and telecom companies to handle heavy data processing and decision making

Case Studies

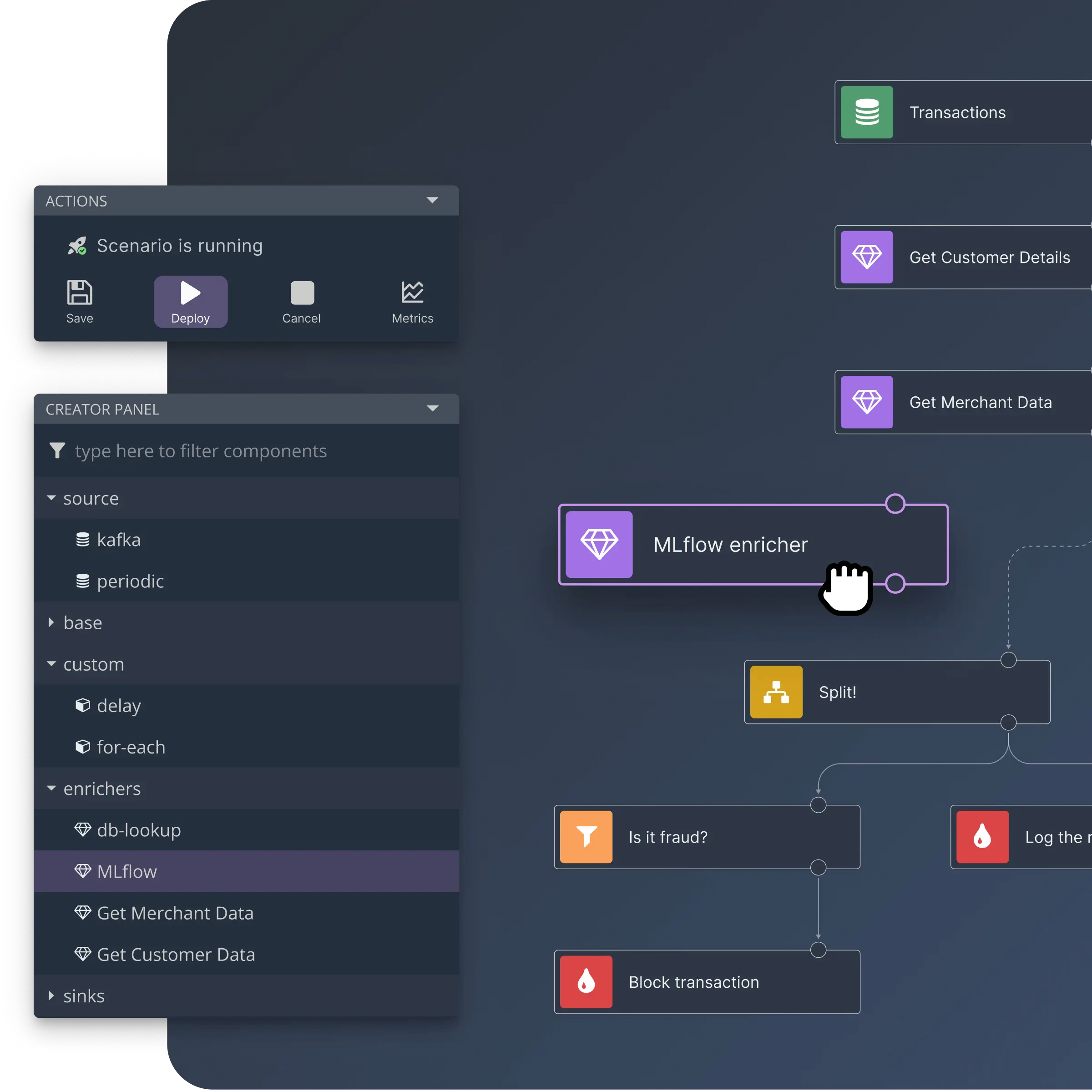

Fintech Low-Code Solution

- data-driven decision-making, empowers teams to act on live data streams for timely and informed decisions,

- open collaboration, enables business and technical users to co-create logic through a single tool,

- customer-centric business model, supports rapid personalization and responsive service based on real customer behavior,

- continuous improvement, allows quick iteration, testing, and deployment of changes without dev operations,

- seamless integration, connects easily with existing systems, data sources, and machine learning models,

- operational efficiency, streamlines processes and reduces development overhead through automation and visual tooling.

Real-Time Financial Solution

- unifies data processing, supports streaming, batch & synchronous (HTTP) data processing,

- intuitive low-code platform, a user-friendly drag-and-drop interface, simplifies the automation of data processing

- machine learning support, seamless ml model deployment & inference solution,

- monitoring & observability, provides real-time metrics, debugging tools, and audit logs for tracking workflows.

Financial Use Cases

Real-Time Fraud Detection System

Live transactions monitoring protection

Real-Time Fraud detection in finance uses machine learning, and analytics to spot suspicious activity and prevent losses. By analyzing transactions and user behavior, institutions can quickly detect anomalies and respond. This strengthens compliance, reduces risk, and builds customer trust.

Loan Decision Rule Engine

Fast & flexible loan approval system

A loan applying system combines an easy-to-manage rule setup with machine learning–based models to automate approval decisions. It analyzes applicant data to deliver consistent, intelligent outcomes without manual input. This improves efficiency, lowers costs, and supports scalable, fair lending operations.

Credit Scoring Service

Accurate & adaptable credit risk assessment

Credit Scoring Service uses automated, machine learning–based models and flexible business rules to deliver fast, accurate, and adaptable credit risk assessments. It enables easy updates to decision logic, supporting frequent policy changes and improving efficiency in lending processes.

Real-Time Marketing

Instant & personalized marketing actions

Instant, event-driven communication enables real-time marketing in financial services by delivering personalized offers and actions based on customer behavior. This approach boosts engagement, increases conversions, and strengthens customer relationships through timely, relevant interactions.

Next Best Action

Intelligent cross-sell & upsell engine

The Nussknacker solution for Next Best Action in finance & banking helps identify the most suitable financial products for each customer, enabling effective cross-selling and personalized offers. It supports BOK teams in tailoring engagement for higher ROI, better retention, and sustained growth.

Real-Time Risk Monitoring

ML-driven operational risk surveillance

Real-Time Monitoring Platform for risk management helps financial institutions detect and respond to emerging threats by analyzing data continuously. Powered by machine learning, it identifies anomalies and market shifts, enabling proactive decisions and reducing potential losses.

Your Partner in Fintech Innovation

Take control of your fintech data strategy and unlock the full potential of real-time insights with Nussknacker's powerful data processing platform. Contact us to start building your solution today.

check the demo in action

discover Nussknacker platform

any questions?